-content.jpg)

As the iGaming industry continues to grow, online platforms need to offer a variety of payment methods that cater to the needs of gamers in the LATAM region, enabling them to expand their reach and attract new customers.

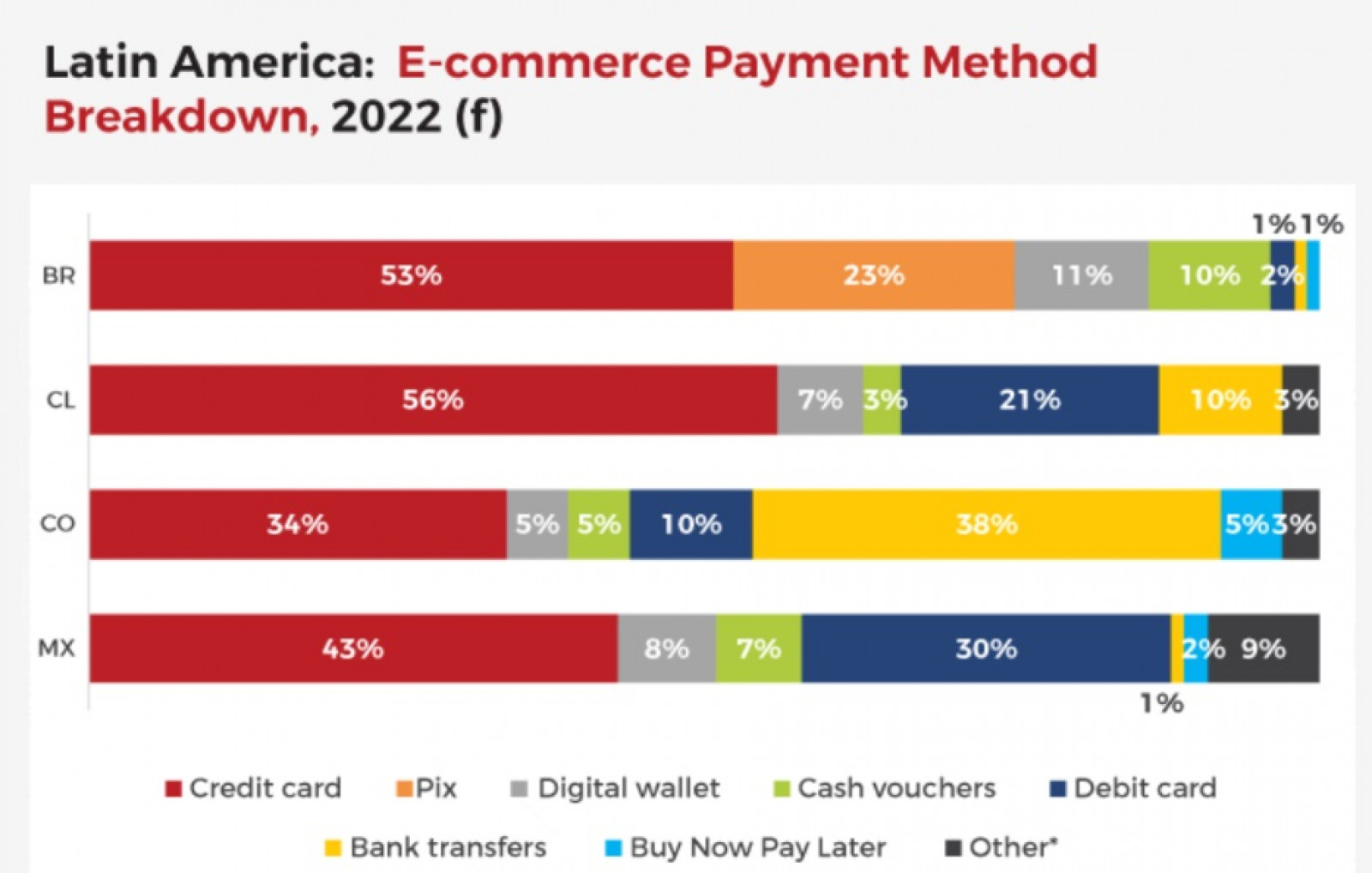

In terms of payment methods, Latin America offers a variety of options for online gaming, including traditional choices such as credit cards and bank transfers, as well as local alternative payment methods (APMs).

In this article, we will discuss the diverse LATAM payment methods, delve into the pros and cons of each method, examine their popularity among gamers, understand common types of fraud, and provide insights on how to avoid it.

Additionally, we will offer an overview of the LATAM payment market in the online gambling industry, along with the challenges and opportunities in this market. Let's dive in.

The Latin American iGaming market is experiencing rapid growth due to the increasing number of internet users and the popularity of online gaming. According to a Statista report, the online gambling market alone in the region is projected to reach USD 3.4 billion by 2025.

The market comprises 20 countries with a total population of 653 million. The majority of the population speaks Spanish and Portuguese, with 66% having internet access and frequent online engagement. Additionally, 60% of the population has access to smartphones, making a mobile strategy an important consideration for companies entering the LatAm market.

Despite its growth potential, there are several challenges that operators and affiliates should consider when evaluating opportunities in the LatAm market.

To begin with, the local language presents a challenge to stakeholders in the region. While only two languages are spoken across most countries, various dialects in the LATAM region significantly differ from those spoken in Europe. Additionally, offering customer service in local languages can be crucial in defining success when launching a LatAm-focused brand, as most people in LATAM prefer to communicate in their native language.

The customer profile is another crucial aspect of LATAM, with a highly localised profile where a "one-size-fits-all" approach is unlikely to succeed due to language and cultural differences between countries.

Moreover, numerous established brands with high budgets invested in traditional marketing channels are more successful through digital channels like affiliate marketing, given their increased exposure. The population's loyalty to well-known brands complicates the market entry for new brands.

Despite these challenges, there are several opportunities for operators and affiliates in the LatAm market:

High digitalization: The region boasts a high level of digitalization, indicating a large potential customer base for online gaming platforms.

Vibrant economy: The Latin American economy is vibrant, offering significant growth potential in the online gaming market.

Credit cards and bank transfers are the most commonly used payment methods in the LATAM iGaming market. They are widely accepted and offer a high level of security. Credit cards are popular for their ease of use and instant deposits, while bank transfers are preferred for larger transactions.

Let's understand the pros and cons of these payment methods:

Credit cards

Bank transfers

However, there are some cons to consider as well:

Transaction fees: Credit card companies may charge transaction fees for using their services.

Slow processing times: Bank transfers can take several days to process, which can be inconvenient for gamers who want to start playing immediately.

Limited accessibility: Not all gamers have access to credit cards or bank accounts, which can limit the number of potential customers.

Local alternative payment methods (APMs) are gaining popularity in the LATAM iGaming market. They offer a convenient and accessible way for gamers to make payments.

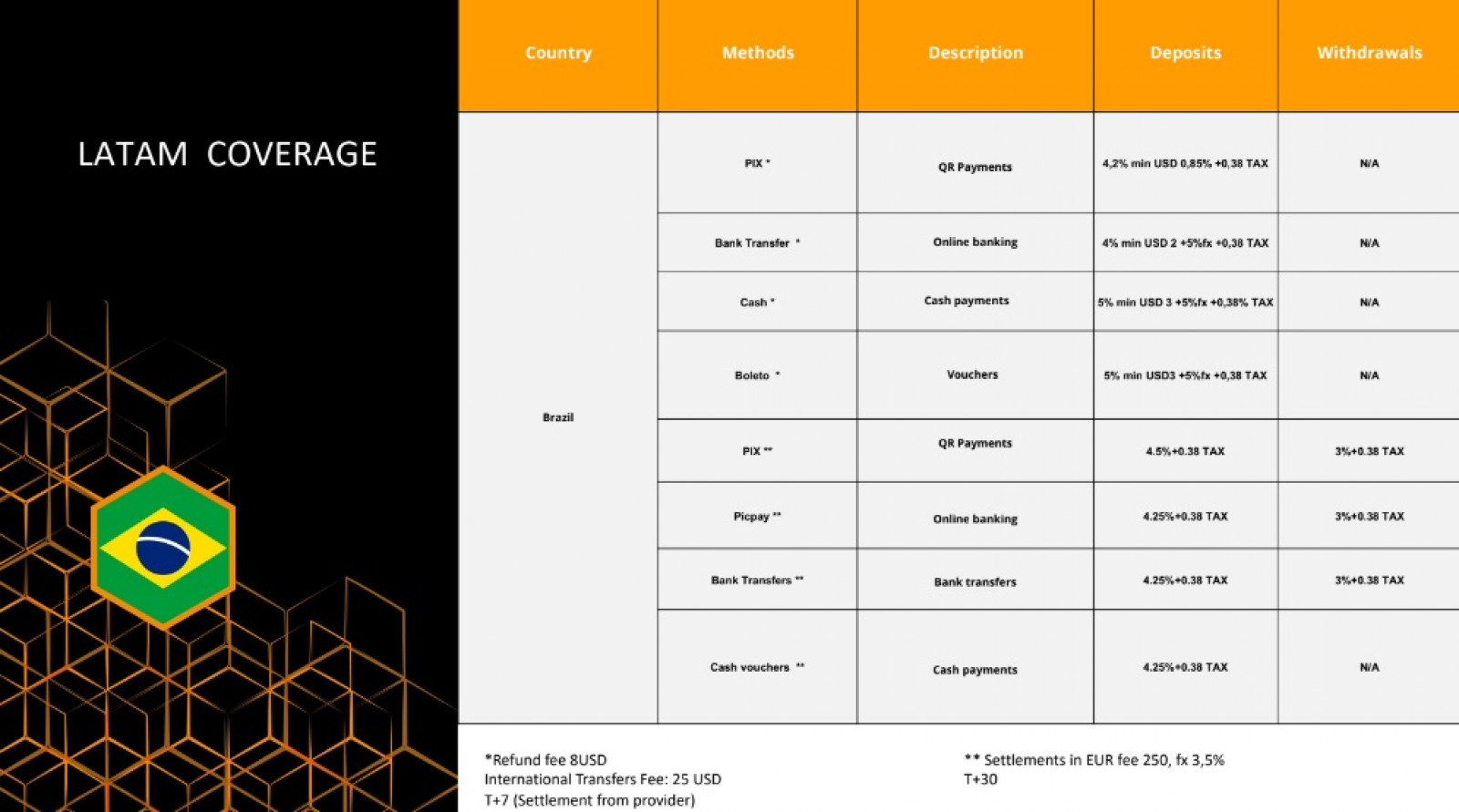

Considering other payment methods, in Brazil, Boleto allows cash payments at local banks or convenience stores. PIX, the most recent, quickest, and easiest payment method in Brazil, enables gamers to make instant bank transfers. In Mexico, OXXO is a similar payment method that allows gamers to make cash payments at local convenience stores. Here are some pros and cons of these payment methods:

Boleto (Brazil)

Accessibility: Boleto is accessible to a wider range of customers who may not have access to credit cards or bank accounts.

Convenience: Boleto is easy to use and offers a seamless payment experience.

Lower transaction fees: Boleto often has lower transaction fees than traditional payment methods.

OXXO (Mexico)

Accessibility: OXXO is accessible to a wider range of customers who may not have access to credit cards or bank accounts.

Convenience: OXXO is easy to use and offers a seamless payment experience.

Lower transaction fees: OXXO often has lower fees than traditional payment methods.

PIX (Brazil)

Instant transfers: PIX allows gamers to make instant bank transfers, ideal for those who want to start playing immediately.

No transaction fees: PIX does not charge transaction fees, saving gamers money.

Secure: PIX is a secure payment method that offers protection against fraud and unauthorised transactions.

However, there are some cons to consider as well:

Limited acceptance: Not all online gaming platforms accept local APMs, limiting the options available to gamers.

Security concerns: Local APMs may provide a different level of security than traditional payment methods.

Language barriers: Some local APMs may require users to navigate websites or forms in a language they are not familiar with, creating a barrier to entry.

With its burgeoning online gaming community, Latin America is not immune to the challenges posed by fraudsters seeking to exploit vulnerabilities in the system. The differences in the socioeconomic status of various communities only reinforce this observation.

The most effective prevention techniques stem from a deep understanding of the environment. Common issues can include, but are not limited to:

Credit card fraud: a common menace where criminals employ stolen card information for unauthorised transactions. To counter this threat, online gambling platforms must institute robust identity verification processes. The use of 3D Secure adds an extra layer of security, and continuous monitoring for unusual transaction patterns can swiftly identify and block fraudulent activities.

Account takeover: involves hackers gaining unauthorised access to user accounts. To prevent this, users should be encouraged to use strong, unique passwords. Platforms should also implement multi-factor authentication and monitor account activities for any irregular behaviour, promptly notifying users of any suspicious login attempts.

Money laundering: a serious concern, where online gambling platforms must implement Anti-Money Laundering (AML) measures. These may include thorough customer due diligence, transaction monitoring, and reporting suspicious activities to regulatory authorities. By adhering to these practices, platforms contribute to the broader effort against financial crimes.

Collusion and friendly fraud should also be mentioned, as they are not uncommon.

Collusion is defined by players or employees manipulating games or taking advantage of bonuses unfairly. Friendly fraud, in turn, occurs when legitimate users dispute transactions, claiming they did not make them. Implementing Fraud Prevention Strategies for LATAM Payments For convenience purposes, refer to this chart:

| Step | Details |

|---|---|

| Identity verification, your first line of defence | Implement robust identity verification processes during account registration and fund withdrawal. By ensuring the legitimacy of users, platforms create a solid foundation for fraud prevention. |

| -------- | -------- |

| Real-time transaction monitoring to unveil suspicious activities | Choose reputable and secure payment gateways that comply with industry standards. This not only safeguards financial transactions but also builds trust among users, enhancing the overall gaming experience. |

| -------- | -------- |

| Secure payment gateways build trust | Choose reputable and secure payment gateways that comply with industry standards. This not only safeguards financial transactions but also builds trust among users, enhancing the overall gaming experience. |

| -------- | -------- |

| Educate users, empowering the iGaming community | IEducate users about the importance of account security, the use of strong passwords, and the risks associated with sharing sensitive information. An informed user base is better equipped to recognise and report potential threats. |

| -------- | -------- |

| Always ensure regulatory compliance | Adhere to regulatory requirements, both as a legal obligation and a crucial aspect of fraud prevention. Platforms must stay abreast of local and international laws, collaborating with authorities to maintain a secure gaming environment. |

| -------- | -------- |

| Do not neglect customer support | Responsive customer support plays a pivotal role in addressing user concerns promptly. By providing assistance and clarification, platforms can foster a sense of security among users, reducing the likelihood of friendly fraud. |

| -------- | -------- |

| Encrypt data to safeguard sensitive information | Implement strong data encryption protocols to protect user information and financial transactions from unauthorised access. This ensures that sensitive data remains confidential and secure throughout the gaming experience. |

| -------- | -------- |

| Collaborate with authorities | Establish a strong collaboration with law enforcement agencies and regulatory bodies. Working together, online gambling platforms and authorities can investigate and address fraud cases, contributing to a safer gaming environment for all. |

| -------- | -------- |

As outlined, payment fraud prevention and building trust go hand in hand.

In recent years, there has been a significant shift in the global management and processing of payments, with Latin America undergoing notable changes. Digital payments have become increasingly prevalent, marking a substantial transformation.

The period from 2020 to 2021 witnessed a more than twofold increase in online payments via bank transfer, accompanied by a steady decline in the proportion of cash transactions. The rise of digital payments stands out as a key development. Now, let's delve into some of the latest trends in payment methods in Latin America.

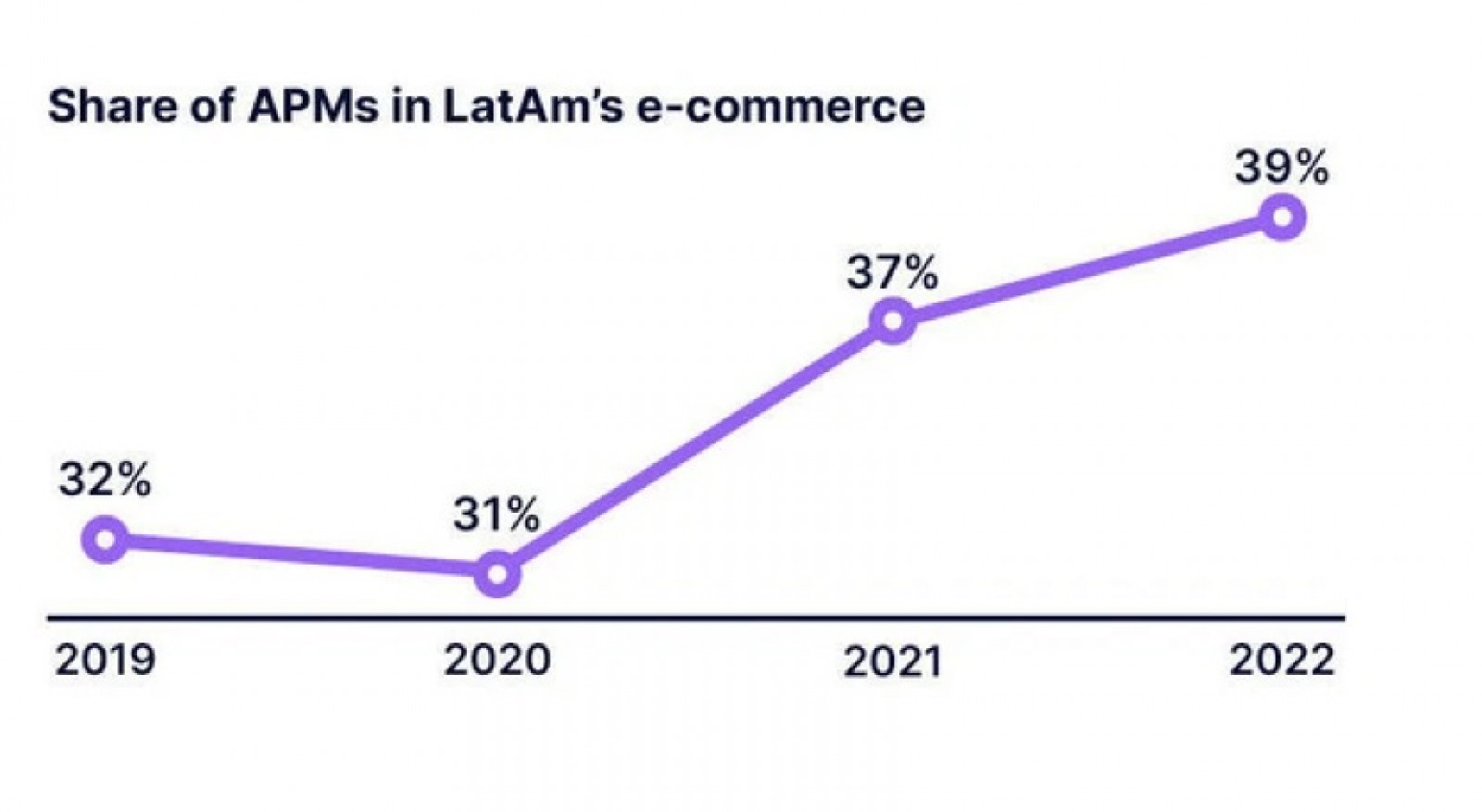

According to the annual study Beyond Borders 2022-2023 by EBANX, Alternative Payment Methods (APMs) are anticipated to constitute nearly 40% of the e-commerce volume in the region. This marks a significant increase from the 31% reported just two years ago, with notable peaks at 55% in Colombia and 46% in Brazil.

The factors propelling this trend include Buy Now, Pay Later (BNPL) solutions, instant bank transfers, and digital wallets. Collectively, these elements contribute to enhancing diversity in the payment landscape of Latin America and actively contribute to reducing cash usage in the region.

The rise of alternative payment methods will have a direct impact on the use of physical cash in Latin America. Payments relying on cash are destined to witness continued decline, with their projected share in the digital commerce of Latin America estimated to be only 7% by 2025.

Instant payments emerge as both the current and future focal points for transactions in the digital commerce of emerging economies. According to a report from ACI Worldwide, these payments are expected to experience a robust 25.6% annual growth rate (CAGR) through 2026, ultimately comprising approximately a quarter of all electronic payments worldwide.

Contactless Payments

Contactless payment methods, including contactless cards and mobile payments, have been growing in acceptance, especially in urban areas. Mobile payment adoption has been on the rise, driven by increased smartphone penetration. Analysts anticipate that Latin America is poised to surpass the United States in terms of having the highest number of mobile wallet users.

By 2020, it seemed that credit and debit cards were on the verge of being entirely replaced by mobile wallets. In such a scenario, banks would witness a notable reduction in their market share for retail transactions. Nevertheless, the emergence of new contactless card technologies, notably near-field communication (NFC) technology, has risen to address this challenge.

NFC facilitates wireless communication between smart devices upon touch or proximity. With NFC-enabled cards, confirming payment is as straightforward as holding them close to a mobile phone, providing a simple method for most merchants to accept bank payments via NFC at the point of purchase. Businesses in Latin America aspiring to differentiate themselves will need to incorporate contactless payments into their operational strategies, whether through NFC or another relevant technology.

Instant Payments

According to a recent report by BIS, over 60 jurisdictions worldwide have introduced instant payment systems. In Latin America, the drive towards account-based transfers is notably spearheaded by two major players: Pix in Brazil and PSE in Colombia, collectively accounting for 90% of the transaction volume in the region.

Additionally, smaller solutions like SPEI in Mexico, Sinpe Móvil in Costa Rica, Simple in Bolivia, Pagos al Instante in the Dominican Republic, and SafetyPay (a regional payment solution that enables account-based transfers for e-commerce purchases, with a more substantial presence in the travel vertical) are also gaining traction.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services were gaining attention in various regions around the world, including Latin America.

These solutions constitute interest-free loans seamlessly integrated at the point of sale. Distinguishing themselves from traditional instalment plans, BNPL stands as a distinct payment method, not merely a feature within cards. It operates independently of cards or accounts and is directly provided by fintech or e-commerce entities through a digitised credit analysis.

Projections indicate that BNPL solutions are anticipated to experience a 21% Compound Annual Growth Rate (CAGR) on a global scale over the next four years. In Latin America, although they represented only 1% of all online purchases in the region in 2022, there have been noteworthy success stories. According to AMI, successful examples include Cuotas in Argentina, Koin in Brazil, Sistecredito in Colombia, and Kueski in Mexico.

Digital Wallets

Digital wallets, also known as e-wallets, have emerged as a robust alternative payment method (APM) in Latin America. These wallets enable customers to make purchases by scanning a QR Code or confirming transactions upon logging into their accounts, contributing to a reduction in fraudulent chargebacks.

In the digital commerce landscape of LatAm, digital wallets have consistently held a prominent position, ranking among the top three payment methods alongside cards and account-based transfers, which include instant payments.

According to a report from Intelligent CIO, the use of digital wallets in Latin America is projected to experience a 20% annual growth until 2025, reaching a value surpassing $70 billion. This would constitute approximately 10% of Latin America's digital commerce market. Argentina and El Salvador are at the forefront, commanding a 23% share, trailing Bolivia at 14%, Peru at 13%, Uruguay at 12%, Brazil at 11%, and Mexico at 8%.

According to Statista, the transaction value of digital commerce in the region was estimated at more than 100 billion U.S. dollars in 2019 and is now expected to increase by approximately 73% by 2025.

Both LatAm and Africa boast a variety of e-wallets and mobile money options. Noteworthy examples include Mercado Pago, operational in seven Latin American countries, and Nequi in Colombia. Additionally, successful platforms such as PicPay and AME are making strides in Brazil.

In the dynamic landscape of the LATAM iGaming industry, the diversification of payment methods emerges as a critical strategy for online platforms seeking to capitalise on the region's burgeoning market. The article extensively covered traditional options like credit cards and bank transfers, emphasising their widespread acceptance and security benefits.

Simultaneously, it sheds light on the rising popularity of local alternative payment methods (APMs), considering their accessibility and lower transaction fees. Despite growth prospects, challenges such as linguistic diversity, local customer profiles, and competition from established brands underscore the need for nuanced market entry strategies.

Let's do a quick recap:

The LATAM iGaming industry faces challenges but offers immense opportunities, especially with the evolving landscape of alternative payment methods and digitalization. As the market continues to grow, staying adaptable to changing trends and adopting innovative payment solutions will be key to success.

Navigating the complexities of the LATAM iGaming market extends beyond payment methods, considering the crucial topic of fraud prevention. As the region undergoes a transformative shift towards digital payments, businesses are urged to adapt to evolving consumer preferences and incorporate innovative strategies to secure a prominent position in this dynamic market.

The gaming industry in Latin America and top payment methods used by gamers in the region

A Guide to the Latin American iGaming Market

The Future of FinTech in Latin America 2023: Insights and Opportunities

Digital payments in Latin America- statistics & facts

Payments trends for 2023 in Latin America and Africa

Digital Payment Trends In Latin America

The 4 main payment trends in Latin America for 2023

Digital Payment Trends In Latin America For 2023

How online commerce and digital payments are connecting businesses and people in rising economies

Developments in retail fast payments and implications for RTGS systems

The Gamingtec website utilizes cookies to store and access visitor information with the purpose of enhancing security and improving the browsing experience. If you do not wish for the collection of such information, you can toggle these off:

Necessary

Necessary cookies are essential for the website to function properly. This category only includes cookies that ensure basic functionalities and security features of the website. These cookies do not store any personal information.

Marketing

Marketing cookies track your online activity to help advertisers deliver more relevant advertising or to limit how many times you see an ad. Said information can be shared with other organizations or advertisers. These are permanent cookies and almost always of third-party provenance.

Analytics & Statistics

Analytical and statistical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, traffic sources, etc.